Experts Predict Approximately 4,000 4S Stores Will Cease Operations This Year: Who Will Bear the Loss for Car Owners? | Ten Questions and Answers

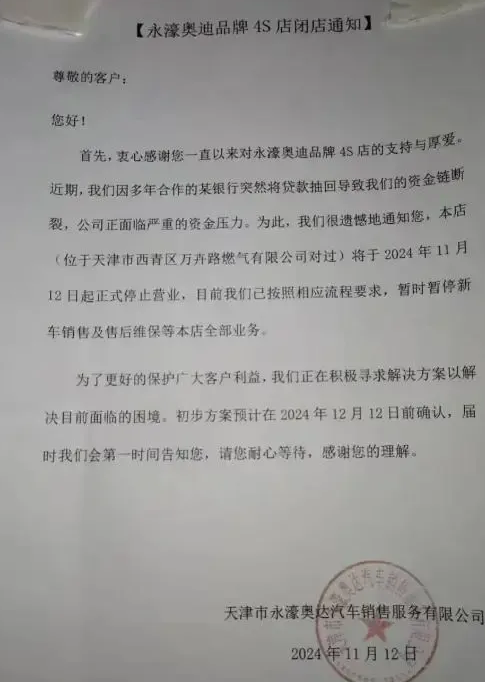

Recently, the largest Audi 4S store in Tianjin was reported to have suddenly closed, sparking widespread discussion within the automotive community. Many car owners expressed concerns that they were unable to utilize their maintenance packages and prepaid funds, as the showroom’s vehicles had vanished overnight and the store remained closed.

In response, the dealership group operating the Audi 4S store, Tianjin Yonghao Group, issued a statement on November 12, explaining that the sudden closure of its stores for Audi, Hongqi, and Dongfeng Honda was due to a severe impact from a long-term banking partner suddenly retracting loans, leading to a broken funding chain.

Since last year, similar incidents have been increasingly common: over 80 4S stores under the long-established Guangdong dealer group Yongao closed overnight; in August, the top three dealer group Guanghui abruptly faced a crisis and was delisted; last month, “Beijing Xingdebao,” the world’s first BMW 5S store, also announced its closure.

Keywords like crisis, closure, transfer, and delisting have become the stark reality reflecting the current survival status of domestic automotive dealers.

In September, the China Automobile Dealers Association issued an urgent report on the “Current Financial Difficulties and Shutdown Risks Facing Automobile Dealers,” warning about the significant bankruptcy risks due to financing difficulties and cash flow deficits.

Are More Dealers Likely to Face Crises in the Future?

As the situation evolves, will we see more dealer crises emerge? If issues arise, how will car owners’ rights be protected? What does the future hold for the industry? Tencent Auto’s “Think Tank Column” invited Lang Xuehong, Deputy Secretary-General of the China Automobile Dealers Association, to provide a comprehensive analysis of the dealer crisis and potential relief strategies through a “Ten Questions and Answers” format.

Key Points:

- Current State: Approximately 4,000 4S stores are expected to close this year due to an oversaturated market and financial crises among dealers.

- Impact on Consumers: Car owners are left in a precarious position when dealerships close, often losing prepaid services or funds without recourse.

- Causes of Closure: The closures are often due to sudden loan retractions by banks, leading to cash flow issues and an inability to sustain operations.

- Market Trends: The automotive distribution network is facing a necessary contraction, with many dealers struggling to adapt to changing market dynamics.

- Future Outlook: More dealers may face crises as the financial pressures increase, heightening the urgency for effective solutions to stabilize the market.

- Consumer Rights: There will be discussions on how to protect the rights of car owners in the event of dealership closures, including potential legal avenues or industry regulations.

- Industry Evolution: The future of automotive dealerships may see a shift towards more sustainable business models and possibly fewer but stronger players in the market.

- Need for Support: There is a call for industry support measures to help struggling dealerships, ensuring better balance in the automotive ecosystem.

- Recovery Strategies: Experts will discuss potential recovery strategies for dealers, including restructuring financing and business models.

- Collaboration: Emphasizing collaboration among manufacturers, dealers, and financial institutions as necessary for restoring stability in the automotive market.

This analysis aims to provide clarity on the pressing issues facing the automotive dealership sector and the implications for consumers, as well as to propose pathways for recovery and a more sustainable future.